Kourosh Ziabari – Fair Observer: Over the past decade, Greece has had a difficult time with a staggering debt crisis and financial stagnation. It began in 2010 just a few years after the global financial crisis and was so severe that Greece could have left the eurozone, the region that uses the euro as a common currency. Some analysts claimed that if Greece had ditched the euro, the financial shocks worldwide would have been more striking than when Lehman Brothers collapsed in 2008, which was the largest bankruptcy in US history.

Greek officials underestimated the depth of the debt crisis and the ensuing recession, and they had to ask for international assistance from the European Union and the International Monetary Fund. Greece received three successive aid packages totaling $330 billion. In return, it had to embrace radical austerity measures. This included a pay freeze for all public sector workers, an end to early retirement, a cut in pensions, an increase in VAT and a rapid shift to privatization.

The economic woes led a social crisis as 400,000 people emigrated and youth unemployment hit 58%. At the same time, public frustration morphed into nationwide protests. Greece’s economic collapse lasted longer than the Great Depression of the 1930s. When Athens received bailouts from the EU and IMF, its ability to meet debt repayments appeared to be highly uncertain.

Greece has the highest unemployment rate in the European Union, followed by Spain, Italy and France. With an annual debt-to-GDP rate of 178.6%, the Hellenic Republic is the second most indebted country in the world after Japan. Despite this, its leaders claim that Greece is on its way to regain financial and political independence.

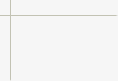

In this edition of The Interview, Fair Observer talks to John Milios, a professor of political economy at the National Technical University of Athens, about the economic situation in Greece and the nation’s debt crisis.

The transcript has been edited for clarity.

Kourosh Ziabari: The Greek debt crisis has historical causes that go far beyond the 2007-08 global financial crisis. I’m talking about the similar debt crisis that happened in 1932 during the Great Depression. Can you tell us about those historical root causes and the reasons they emerged?

John Milios: I do not see any relevance between the two historical periods and the respective Greek debt crises, except the fact that they both took place amidst a global financial meltdown and were triggered by it — on the one hand the Great Depression, and on the other the global financial crisis.

The debt crisis of 1932 took place after 10 years of Greek expansive wars against the Ottoman Empire between 1912 and 1922, which resulted in enormous military expenses, ending up with the so-called “Asia Minor Disaster” — that is the defeat of the Greek army in Anatolia by the Turkish national liberation forces under Kemal Ataturk. The military defeat of Greek imperialism resulted in more than a million Greek refugees, living until then in the Ottoman Empire, who entered Greece with practically no belongings in 1922, incurring colossal public expenses for their subsistence, housing, etc.

The recent crisis had to do with the policies of the European elites, including the Greek one, and the structure of the eurozone. The euro is a national currency of a peculiar kind. It is a currency without traditional central banking. This was a major political decision of the ruling economic and political elites in Europe, aiming at securing a framework of permanent fiscal tightness, which would curtail the welfare state and transfer all pressure from international competition on the shoulders of labor. In other words, these political decisions were aimed at making neoliberal policies irreversible.

The monetary aspect of the eurozone is unique: The European Central Bank does not play the role of a lender of last resort and market maker of last resort. Member states issue debt in a currency that they do not control in terms of central banking.

In this context, governments are exceptionally restricted in securing liquidity to pay off bondholders. Financial stability can be thus safeguarded only through “fiscal discipline.” In times of fiscal distress, the dismantling of the welfare state can be presented by the political and economic elites as the only route to “financial sanity.” This may be a beneficial condition for the interests of capital, but it is also dangerous. It imposes the neoliberal agenda by elevating default risk.

European states — or, in other words, the European ruling classes — have voluntarily placed themselves in a predicament where markets can actually force them into default. However this is an issue within the European policy setting, a type of conservative governance. It is not by chance, then, that it was not only Greece, but also Portugal, Cyprus and Ireland that faced acute debt crises, whereas other countries, like Spain and Italy, faced a severe debt overhang.

Ziabari: For a quarter century — i.e., the early 1950s to mid-1970s — Greece’s GDP growth rate was spectacularly high and second in the world after Japan. How did the nation achieve such an economic miracle? Why wasn’t it able to maintain this accomplishment?

Milios: The two factors or preconditions determining capitalist growth are, in all cases, discipline of the working class — usually combined with relatively low wages — and fast technological change. After the defeat of the left in the civil war between 1946 and 1949, Greek capital has safeguarded both preconditions. The growth rates of the Greek economy were also high before the 2007-08 crisis.

That was also the case with other EU countries that faced a debt problem after 2008. In particular, during the period of 1995 to 2008, Greece experienced a real increase of GDP amounting to 61%, Spain 56% and Ireland 124.1% — quite contrary to what happened in the more developed European economies. The GDP growth over the same time period was 19.5% for Germany, 17.8% for Italy and 30.8% for France. Economies that experienced higher growth rates ended up with noticeable current account deficits and correspondingly high capital surpluses. This asymmetry of the eurozone was proven to be a very vulnerable configuration in the conjuncture of the global crisis. The crisis brought to an end capital transfers and fully reversed growth to recession.

Ziabari: According to Eurostat, the Greek government’s debt-to-GDP totaled 178.6% in 2017. Greece continues to be the most indebted country in the European Union. Do you think the government will be able to overcome this situation in the near future? Does it have any effective plans to do so?

Milios: No, they do not have any plans. In the eurozone, public debt is a mechanism promoting austerity policies. Governments have agreed to produce high primary surpluses in order to lower the debt ratio. These surpluses mean less money for welfare services; 179% is a very high debt ratio, of course. However, the debt ratio of Japan is considerably higher — 229.6% of the GDP in 2017 — without the country facing any default risk, since the Bank of Japan guarantees its solvency, in stark difference from the policy of the European Central Bank.

Ziabari: Greece has scheduled debt repayments to the European Union until 2059. In return for the loan to rescue Greece financially, the EU required Athens to adopt austerity measures. Do these mean that Greece is a bankrupt economy?

Ziabari: Greece has scheduled debt repayments to the European Union until 2059. In return for the loan to rescue Greece financially, the EU required Athens to adopt austerity measures. Do these mean that Greece is a bankrupt economy?

Milios: Austerity is the rule all over the eurozone. Austerity is neither a “false” nor a “correct” policy. In reality, it is a policy promoting the economic, social and political interests of certain social groups, as opposed to others, especially after the outbreak of the global financial crisis.

Austerity constitutes the cornerstone of neoliberal policies. On the surface, it works as a strategy of reducing entrepreneurial cost. Austerity reduces labor costs of the private sector, increases profit per labor unit cost and thereon boosts the profit rate. It is complemented by institutional changes that, on the one hand, enhance capital mobility and competition and, on the other, strengthen the power of managers in the enterprise and share and bondholders in society. As regards to fiscal consolidation, austerity gives priority to budget cuts over public revenue, reducing taxes on capital and high incomes, and downsizing the welfare state.

However, what is cost for the capitalist class is the living standard of the working majority of society. This applies also to the welfare state, whose services can be perceived as a form of “social wage.”

It is clear, therefore, that austerity is primarily a class policy: It constantly promotes the interests of capital against those of the workers, professionals, pensioners, unemployed and economically vulnerable groups. In the long run, it aims at creating a model of labor with fewer rights and less social protection, with low and flexible wages and the absence of any substantial bargaining power for wage earners.

Ziabari: Adopting austerity measures pushed back the economic growth of Greece considerably. Despite the difficulties it has been wrestling with, why do you think Greece didn’t leave the eurozone? How did it manage to remain in it?

Milios: Austerity is the strategy of the ruling classes. Austerity does lead, of course, to recession. However, recession puts pressure on every individual entrepreneur, both capitalists or middle bourgeoisie, to reduce all forms of costs — that is to try to consolidate her or his profit margins through wage cuts, intensification of the labor process, infringement of labor regulations and workers’ rights, massive redundancies and so on.

From the perspective of big capital’s interests, recession gives birth to a “process of creative destruction”: redistribution of income and power to the benefit of capital; and concentration of wealth in fewer hands as small and medium-sized enterprises, especially in retail trade, are “cleared up” by big enterprises and shopping malls.

The ruling class does not have any interest to end austerity or to leave the eurozone. For the working class and the poor, leaving the eurozone is also not a panacea. What will happen, for example, in the case of an immense devaluation of the new Greek currency? Maybe some fractions of capital will benefit, say, exporters or the services sector, but the living standard — the cost of living — of the working majority will deteriorate.

Ziabari: Some 50% of Greek youths are unemployed, while the overall unemployment rate is 25%. With the current difficulties the government is facing, do you foresee a more promising future for the labor market?

Milios: Conditions in the labor market are “improving” in the sense that the unemployment rate has fallen to 20%. However, this is an enormous rate if you compare it with the 7-8% before the crisis. Besides, average wages have been reduced by more than 25%. So, the “improvement” is moderate, slow and contradictory. Only a revival of the labor movement, I think, can give more momentum to the process.

Ziabari: Transparency International ranked Greece 59 out of 180 in its Corruption Perceptions Index 2017. Do you consider corruption to be a major issue for Greece and pivotal to its economic challenges?

Milios: As it always takes two to tango, corruption was the “traditional” method to forge a social coalition between the capitalist class and certain layers of the public sector. Maybe the major difference between northern European countries and Greece is that in the latter case, corruption took a more “lay” character — that is, it has dispersed also in the middle and even the lower strata of the state apparatuses. It is a serious social and political problem.

Ziabari: Revenues lost due to personal income tax evasion make up some 1.9% to 4.7% of annual GDP in Greece. Who are the people that don’t pay their taxes? What can be done to solve this problem?

Milios: The problem is twofold. First, legal tax excuse for big capital, supposedly as a means to promote growth. This is considered to be a sane policy, and all establishment parties compete with each other on how taxes on capital can be further reduced. Second, tax evasion of the middle strata, namely small entrepreneurs and self-employed. The only social groups that cannot avoid taxation — and so carry the major burden — are the working class and, more generally, wage earners.

Ziabari: Greek Prime Minister Alexis Tsipras recently said, “Greece is once again becoming a normal country, regaining its political and financial independence.” Do you agree? Is it on the path to growth?

Milios: As Karl Marx wrote more than 150 years ago, “permanent crises do not exist.” This is no reason for politicians to boast. Especially for politicians, like Tsipras and other European leaders, who promote neoliberal and austerity policies.

This interview was originally published on Fair Observer.